Many leaders of successful towing and recovery businesses start small, growing their businesses from one or two trucks to a bigger fleet. However, when you reach the point where you need more equipment to scale the business, you might not have enough funds to buy or rent tow trucks and other equipment when you need it. That’s where an equipment financing source can partner with you and your company to support the necessary growth.

Before you get started, there are some things to know so you can put your best foot forward with a reputable lender who specializes in tow truck financing. Don't worry if you're not a finance guru. Marcus Messier, Vice President – Equipment Finance is First Business Bank’s expert on towing and recovery equipment, so we asked him for his insight into the details you should keep in mind before seeing a lender.

Why Prepare for Tow Truck Financing?

With just a little preparation, you can accurately represent the story of your business to support your tow truck financing request. When you can do that successfully, it’s the key to getting a quicker financing decision and a favorable rate. By taking these proactive steps, you're not just securing financing for your tow trucks —you're investing in the future success of your towing and recovery business.

“Many times, we’re working with towing and recovery company owners who need equipment quickly because they have an opportunity to grow their business,” Messier said. “You may want to consider adopting the perspective of the financier and recognize that when seeking a large sum of money, the more favorable and compelling the narrative you present for your growing business, the more likely you are to secure the financing package you want while saving time and energy.”

Before we get into the details, it’s important to mention that some lenders, like First Business Bank, often only require an application for equipment requests of less than $250,000. Typically, the more financing you need, the more information a lender will need from you.

"If you’ve been in business fewer than three years, we often ask for more financial information to gauge the health of your business,” Messier said.

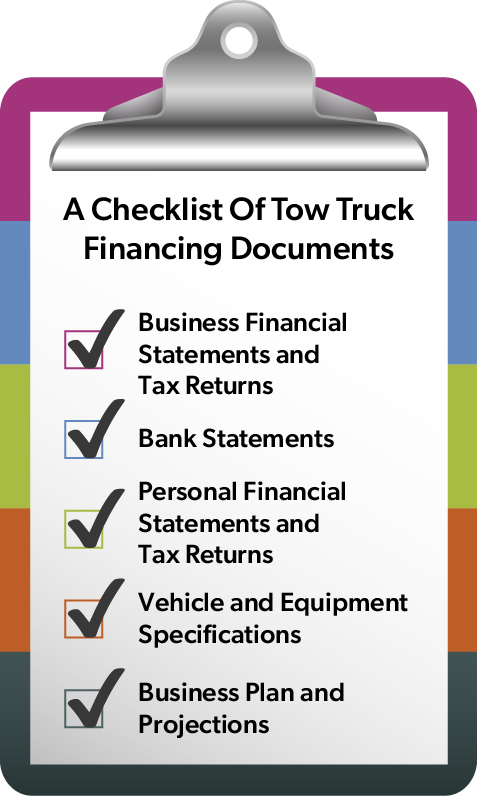

A Checklist of Tow Truck Financing Documents

When you decide to finance equipment for your business, you’ll want to be prepared with documents that show a history of your business.

“First things first — paperwork is boring compared to towing and recovery vehicles, but it’s necessary for getting a loan or lease,” Messier said. “You may not need all of these documents in every case, but I’ve seen lenders require these for one business or another.”

“First things first — paperwork is boring compared to towing and recovery vehicles, but it’s necessary for getting a loan or lease,” Messier said. “You may not need all of these documents in every case, but I’ve seen lenders require these for one business or another.”

Business Financial Statements and Tax Returns: These documents show how your business is doing financially. They include profit and loss statements, balance sheets, and tax returns for the past two to three years.

Bank Statements: Lenders may ask for your last three months of bank statements for your business.

Personal Financial Statements and Tax Returns: In some cases, lenders want to see your personal finances. So, be ready with your personal tax returns and a statement of your personal assets and liabilities.

Collateral and Down Payment: Collateral for a towing equipment loan is typically like-type equipment. For instance, if you own other pieces of towing and recovery equipment outright, that could serve as collateral for the equipment you want to finance. A larger down payment, while presenting less risk for the lender, reduces the loan principle and payment, and may also result in a lower interest rate and better terms.

Vehicle and Equipment Specifications: Details about the vehicles you want to finance, including year, make, model, and price, are necessary. If the equipment is used, a condition report is helpful to a lender.

- Towing equipment, including wreckers and carriers: Include, if available, a bill of sale / buyer's order or year, make, model, mileage, details about the wrecker / carrier's body and equipment, including towing capacity, boom specifications, carrier body length, body capacity, and any additional features or accessories.

- Heavy wreckers, carriers, and rotator financing: Include, if available, a bill of sale / buyer's order or year, make, model, mileage, Specify the manufacturer, body model, lifting / carrying capacity, boom length, under-reach capacity, number of winches and capacity, and maintenance records if it’s a pre-owned unit.

- Roadside assistance vehicle financing: Include, if available, a bill of sale / buyer's order or year, make, model, mileage, any compartments or toolboxes, and diagnostic equipment.

Business Plan and Projections: A simple business plan that outlines your business goals and how you plan to achieve them. It also includes financial projections for the next few years.

Preparing for Tow Truck Financing: A Step-by-Step Guide

Now that you know what documents you may need, let's talk about how to prepare for the towing vehicle financing process.

Review Your Financial Situation: Look at your current cash flow and debt-to-income ratio. If you have a lot of debt compared to your income, you might need to pay some of it down before applying for tow truck financing.

Research Lenders and Financing Options: Not all lenders are created equal. In fact, you may often find better cost of funds from a direct lender, like First Business Bank, unlike brokers who mark up financing to make a profit.

Organize Your Documents: We suggest organizing your suggested documents from the checklist and keep them in a safe and easily accessible place.

Strengthen Your Loan Application: A solid business plan and realistic financial projections can strengthen your loan application. If you're unsure how to create these, consider seeking help from a business advisor or accountant.

Seek Professional Guidance: Don't be afraid to ask for help. Consult with financial advisors or accountants and utilize resources from industry-specific associations.

What Happens After Applying for Tow Truck Financing?

At First Business Bank, as well as most lenders, this is where the underwriting process begins.

“After communicating with the prospective borrower, the analyst team will begin to gather the supporting documents, usually starting with pulling a report from PayNet and a FICO score,” Messier said. “The PayNet report outlines your company’s credit score. It’s a credit report for businesses showing their past loan and payment history, current available credit, any tax liens or bankruptcies, and other important data that will provide insight into the borrower’s credit worthiness.”

FICO scores, calculated from your personal financial history, range from 300 to 850, and are intended to show a person’s ability to pay back a loan – their “creditworthiness.”

"At First Business Bank, we understand the unique financing needs of the towing and recovery industry," Messier said. "We take a comprehensive approach to evaluating each application, considering a range of factors to determine creditworthiness. What sets us apart is our willingness to work with start-up towing and recovery companies that have been in business for three years or fewer. We strive to provide tailored financing solutions that support the growth and success of businesses in this essential industry."

Next, if the tow truck financing is approved, the lender puts together a financing agreement, which lays out all the terms and conditions, including the rate and repayment terms. Then, you’ll either meet with your lender to sign the paperwork or electronically sign if your equipment financing company works with electronically signed documents.

What Happens If You Have a Bad Credit Score?

It happens. Business is a risk, and unforeseen issues can spiral into problems that reflect on your personal or business credit. Is there any leniency for issues that crop up?

“In the event that a known credit score may be lower than required, it helps if the borrower is honest and open,” Messier said. “It helps to tell a story. For example, we recently attended the American Towman Exposition in Baltimore, Maryland, and we spoke with a potential customer who was completely forthcoming about his business struggles because of the COVID-19 pandemic and subsequent medical bills. This, however, did not prove as a deterrent though as in many situations we are able to make an exception for medical debt. The idea is to talk to us. Has there been a recent divorce? Did something happen with your company where it has just lost a major municipal contract or severed ties with a motor club? The more the lender knows and understands about your business the more the chances of a favorable approval increase. We’re all human beings and life happens.”

What To Know About Financing Used Towing Equipment

We all know there’s a lot of life in some towing equipment and you don’t necessarily need to always buy new when you’re expanding your fleet. We are commonly asked how used equipment changes the financing end.

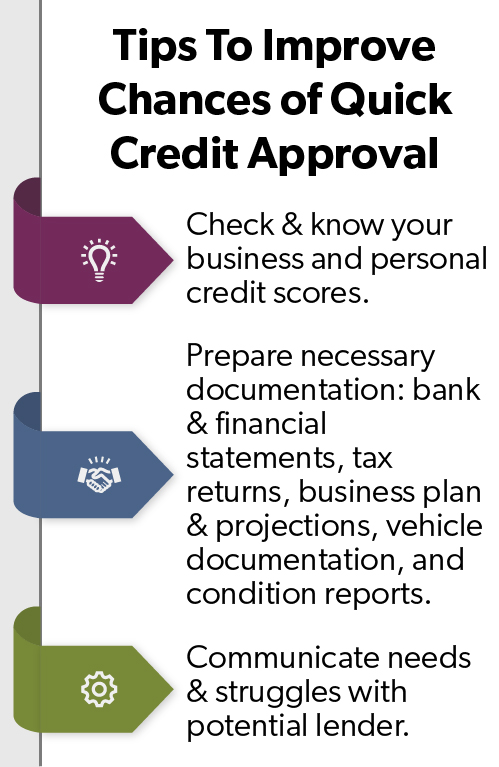

Tips To Increase Your Chances of Obtaining a Credit Approval Quickly

Here is a quick summary of ideas and documentation that will increase the probability of obtaining a credit approval with favorable terms that you may accept at the speed of business. All situations may not require all the financial information, and remember that each lender has specific criteria, so tailor your approach based on the type of credit you’re seeking.

Check and know both your business and personal credit scores

Check and know both your business and personal credit scores- Prepare necessary documentation

- Bank statements

- Financial statements

- Tax returns (business and personal)

- Business plan and projections

- Vehicle buyers order, bill of sale, or equipment invoice

- Condition report if equipment is used

- Maintenance history

- Condition report if equipment is used

- Communicate needs and struggles with potential lender

Taking proactive steps. like preparing maintenance records and having transparent discussions with lenders, shows you understand the ins and outs of funding used equipment. This diligence and openness increase the chances of securing favorable financing terms quickly to acquire the assets you need. Whether for used machinery or other needs, a tailored approach gets you the credit to match the speed of your thriving business.