We often hear from business owners and executive leaders that viewing their business’s operations from a banker’s lens is helpful in many ways. Focused on the day-to-day obligations of running a business, business leaders often find it challenging to dedicate time to strategic planning and hunting down operational efficiencies.

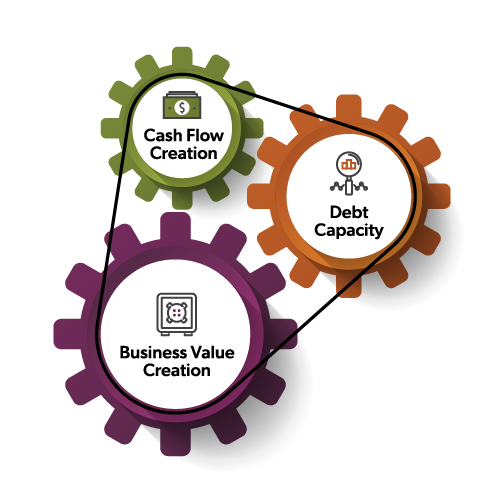

After all, most business owners’ wealth is also very closely tied to their businesses, so improvements in the business’s operational efficiencies and cash flow can pay off significantly when it comes to transitioning the business. Known for proactive conversations to help clients succeed, leaders at First Business Bank launched Business Advisory Services, a value-added framework of solutions that encompass evaluating and improving cash creation, business value creation, and debt capacity for clients.

After all, most business owners’ wealth is also very closely tied to their businesses, so improvements in the business’s operational efficiencies and cash flow can pay off significantly when it comes to transitioning the business. Known for proactive conversations to help clients succeed, leaders at First Business Bank launched Business Advisory Services, a value-added framework of solutions that encompass evaluating and improving cash creation, business value creation, and debt capacity for clients.

In this article, Chief Risk Officer Laura Garcia and Jim Hartlieb, President & CEO of First Business Bank, share their perspectives on how Business Advisory Services helps business owners who will transition their business ownership, either through a sale or handing it down to the next generation, in the future.

“These concepts are important no matter where your business is at in its life cycle,” Hartlieb says. “These strategies allow business owners to know where to focus their energy, goals, and objectives.”

Business Advisory Services provides value-added solutions to clients through an analysis of the company’s financial statements and provides clients with best practices from the point of view of a bank.

“It’s important to emphasize that we are not telling them how to run their business,” Garcia says. “These are discussions that are intended to guide business owners from a best-practices perspective and make them aware of opportunities for improvement.”

How We Assess Cash Creation

Cash creation quantifies the amount of cash a company can generate through more effective management of key working capital inputs – inventory, receivables, and payables.

“We use the information from your financial statements and peer industry data to assess the company’s potential to increase its cash,” Garcia says. “Access to additional cash provides a company with the options to invest in its growth, reduce debt costs due to rising rates, or make additional capital expenditures.”

Some questions that might arise during a cash creation discussion include:

- What are the working capital trends for this company?

- How do these trends compare to industry peers?

- What impact does more efficient management of working capital have on cash?

- How can the company improve working capital efficiency? What are some industry best practices?

- What products and services are available to the company to improve working capital?

- How can the company deploy this cash to achieve its strategies or goals?

What Is Business Value Creation, And Why Is It Important?

Every business owner will, at some point, decide to transition the company to a family member, their employees, or to a third party. Business value creation identifies long-term, strategic opportunities to increase the value of the company.

“When you’re planning for the eventual succession of a business, it takes time to ensure a maximum return,” Garcia says.

Business value creation is a dynamic tool that can work in tandem with business succession planning but is indispensable for driving strategic growth. Whether you’re a business owner embarking on a five-year plan to expand your facility, launch a new product line, or acquire another company, the concept of value creation plays a pivotal role in steering these strategic conversations.

“Think of it as an ongoing game plan for building and fortifying the primary asset — your business — with an eye on the long game,” Hartlieb says.

Consider this scenario: you might have two decades left before you’d like to retire, but the question remains — what steps can you take now to ensure your company is well-positioned to seize the best market opportunities down the road? The answer often lies in meticulous planning of an equipment expansion, revamping your facilities, adding warehouse space, or taking on a major client that could significantly increase your company’s capacity utilization. This strategic foresight is imperative.

“A variety of considerations demand planning — all with the end goal of enhancing your business’s value through increased earnings, growth, and profitability,” Garcia says. “Tax planning for business owners also goes hand in hand with discussions about business value.”

How Does Debt Capacity Work?

The inevitable question then arises — how do you finance these initiatives? That’s where the concept of debt capacity comes into play, providing a roadmap of options that delineate how much funding can come from the bank, how much from equity, and what other financing avenues are available to turn your strategic vision into reality.

Business value creation and debt capacity are strategic allies that provide a financial framework to support your expansion, innovation, and market advantage strategies, ensuring that you’re well-prepared to capitalize on opportunities, whether they’re on the horizon or still a few years away. As a business owner or executive leader, it’s imperative to recognize these tools as not just abstract concepts but as actionable pillars of your strategic arsenal, guiding you toward a future of sustainable and profitable success.

How Do Business Advisory Services Impact Private Wealth?

Although our Private Wealth clients come from all walks of life, many are business leaders, and Business Advisory Services discussions carry over to impact your personal wealth. More than 50% of businesses expect a leadership change within the next ten years, and our Private Wealth advisors work with accredited third parties to assist you in the business valuation process.

Although our Private Wealth clients come from all walks of life, many are business leaders, and Business Advisory Services discussions carry over to impact your personal wealth. More than 50% of businesses expect a leadership change within the next ten years, and our Private Wealth advisors work with accredited third parties to assist you in the business valuation process.

“You might be thinking you’re 20 years from retirement, but what do you do between now and then so the company is poised to take advantage of the best market opportunity?” Garcia says. “You might think it’s a long time, but you may need to do a lot of planning between now and then to increase the value of your company to ensure you reach your retirement goals.”

First Business Bank’s Private Wealth team also offers value-added, complementary support to help with:

- Contingency Planning: Unplanned events, such as departure, disability, or divorce, can drastically impact a business, its owners, and stakeholders. Planning for these specific contingencies can ensure time for thoughtful consideration and protection. Our Private Wealth advisors can help you consider your key contingencies, establish structures of support, and identify steps you should evaluate.

- Buy-Sell Agreements: Our team of advisors can help you evaluate the liquidity you may require and funding options to execute without a financial burden when the time comes.

- Succession Planning: Roughly half of business owners address the disposition of their business in their estate plan, and a very small fraction review and revise their plans frequently. Our Private Wealth advisors guide you through the process of planning for the leadership and ownership succession of your business. With careful tax planning, we’ll also ensure that your business interests are accounted for in your estate plan so distribution to the next generation happens as you direct.

- Liquidity Event Planning: Gain peace of mind as you work with an experienced Private Wealth advisor to consider the steps you should take to maximize the value of your business. Our team keeps your estate plan front and center, offering ways to maximize the personal value you receive from a liquidity event and integrating your personal wealth planning and estate plan.

Through Business Advisory Services, we support business-side financials and meet business owners’ personal financial needs. By taking the time to ask a lot of questions, we learn about the strategic objectives of your business and your own personal wealth goals to advise on how to effectively manage your cash flow, increase the value of your business, and use debt to appropriately invest in your company.