Small and medium-sized businesses account for most employers and new jobs each quarter. However, only a small portion of the owners of these businesses successfully transition their companies. By some estimates, between 25% and 30% of private companies have a succession plan, meaning the majority do not, which can have devastating consequences for owners, their families, and their employees.

Without a succession plan, heirs or other owners may be forced to sell the business quickly under duress, potentially at a fraction of the full value. But what if you could start a business with the end in mind? What would you need to consider at the very beginning that would help the founders realize the most value from transitioning the company?

As millions of Baby Boomer-owned businesses are sold or transitioned each year, and the trend is expected to continue in the coming years, Brad Howe, CFA, CFP®, Senior Vice President – Wealth Advisor at First Business Bank, provides insight into ways to set up a business to succeed through transition at the very start.

Building Value For Your Business Exit

As much as optimistic business owners might like to avoid thinking about it, every single one will exit their business at some point. Starting a business with the end in mind is a strategic approach that involves planning for the eventual exit or transition of the company from the very beginning.

“Business owners are often focused on the next quarter or next year,” says Howe. “When you start with a plan that maps out an exit, the idea is that you can make decisions that fit into those long-term plans, so when it’s time to move on, your business is worth its full value.”

Here are some key considerations when starting a business with the end in mind.

Define A Likely Business Exit Strategy

While it might seem odd to immediately determine how you’d transition the business, making a choice now does not necessarily lock you into a specific option. Common exit strategies include retiring, selling the business, transitioning it to an Employee Stock Ownership Plan (ESOP), passing it on to family members, merging with another company, or taking it public through an IPO (Initial Public Offering).

While it might seem odd to immediately determine how you’d transition the business, making a choice now does not necessarily lock you into a specific option. Common exit strategies include retiring, selling the business, transitioning it to an Employee Stock Ownership Plan (ESOP), passing it on to family members, merging with another company, or taking it public through an IPO (Initial Public Offering).

“You can think about choosing an exit strategy and a business structure kind of like selecting the right vehicle for a long road trip,” Howe says. “Like a cross-country trip, your choice now doesn’t lock you into a specific destination; instead, it sets you on a path that aligns with your ultimate goals. Just as a well-chosen route can make your journey smoother and more efficient, selecting the right business structure and exit strategy from the start can significantly enhance the value and success of your business down the road. The key is to remain adaptable and open to adjustments as your business evolves, ensuring that your chosen path remains in sync with your desired destination.”

Choose The Right Business Structure For Your Exit Strategy

Selecting the appropriate business structure from the start is a critical step in aligning your business with your exit strategy. It can have a significant impact on the ease and financial implications of transitioning or selling your business down the road. Each structure comes with its own tax implications, affecting how much you pay in taxes and how profits are distributed among owners or shareholders.

“Choosing the right business structure from day one isn’t just a formality,” says Howe. “It’s a strategic maneuver that sets the stage for your business’s entire journey. It lays a solid foundation for stability, scalability, and longterm success.”

Here are common business structures and how they might affect exit strategies.

- Sole Proprietorships and Partnerships: For those considering an eventual sale or transition, sole proprietorships and general partnerships may not be the most suitable choices. These structures lack the legal separation between business and personal assets, potentially exposing owners to greater personal liability. They can complicate the sale process, making it less attractive to potential buyers.

- Limited Liability Companies (LLCs): LLCs offer a flexible structure that can be ideal for businesses with an exit strategy in mind. They combine limited liability for owners with pass-through taxation, providing potential tax benefits. Moreover, the structure can be easily converted into different forms if needed.

- Corporations: If selling your business to external parties, forming a corporation is often a preferred choice. It grants a clear separation between personal and business assets, which can bolster your business’s appeal to potential buyers. Also, corporations can issue different classes of stock, easing equity distribution among investors or family members during a transition.

- S Corporations: S corporations are particularly appealing for those looking to eventually sell to a smaller group of investors or family members. They offer the benefit of pass-through taxation while still providing the liability protection of a corporation. However, they come with certain restrictions, such as limitations on the number of shareholders.

- C Corporations: C corporations are a solid choice if your exit strategy involves going public or attracting many investors. They offer the broadest flexibility in terms of ownership and are well-suited for larger-scale operations. However, they have their own tax implications and reporting requirements.

Keep in mind that the business structure you choose isn’t set in stone. It’s possible to change structures down the line if your exit strategy evolves. For instance, you might start as an LLC for flexibility and then convert to a corporation as your business grows and you prepare for a sale.

Design A Scalable Business

When starting a business with an eye on the future, scalability should be a key consideration. A scalable business model can grow and expand efficiently as demand increases or new opportunities arise. This strategic approach is not just about dreaming big; it’s about structuring your business to handle growth effectively.

“When starting your business, think about how it can grow and adapt to the future,” Howe says. “A scalable business model helps you to navigate the changing entrepreneurial landscape with confidence.”

Some steps to take to improve the scalability of your business include:

- Streamlining your operations

- Investing in technology

- Implementing flexible staffing models

- Offering products or services that can adapt to meet changing needs or expand to new markets

- Understanding your working capital needs and potential financing options to prepare for growth

- Listening to customer feedback to enhance your products or services

- Planning for contingencies, like increased competition or workforce challenges

- Adapting and evolving to refine your strategies so they align with your long-term goals

Understand Taxation Differences For Businesses

Taxes aren’t just an obligation — they’re a dynamic factor that can significantly impact your business’s profitability, valuation, and eventual exit strategy. Along with your business structure, other factors relating to taxes when you first start your business include:

- Proactive tax Planning as a tool for strategic growth. Leveraging tax incentives, deductions, and credits can free up capital for reinvestment, fueling your business’s expansion.

- Tax implications of your planned exit strategy. When it comes time to exit your business, the tax treatment of the sale proceeds can significantly impact your wealth. Understanding how capital gains taxes apply is essential for optimizing your financial outcome.

- Estate tax effect on your heirs. Estate planning is critical for business owners eventually considering a transition to family members or heirs. It can help minimize estate taxes, ensuring a smoother and more tax-efficient transfer of assets.

- Impact of state and local taxes. Where you incorporate your business and its location both affect the taxes your business will pay — and can vary widely. Be aware of income taxes, property taxes, and other levies that might apply.

- Tax efficiency on your overall wealth. Keep your long-term goals in mind when making financial decisions. Short-term tax savings should not come at the expense of long-term tax efficiency, which can have a more substantial impact on your wealth.

- Changing tax regulation on your business. Taxation evolves over time, so it’s essential to stay informed about legislative changes and adapt your tax strategies accordingly. Be prepared to adjust your business’s financial plans to align with the shifting tax landscape.

“Estate planning isn’t just about preserving wealth,” Howe says. “It’s a strategic maneuver that empowers entrepreneurs to navigate the complexities of estate taxes efficiently. By proactively structuring your affairs, you can ensure that your hard-earned assets pass smoothly to the next generation, minimizing the burden of estate taxes and securing your legacy.”

Protect And Leverage Intellectual Property

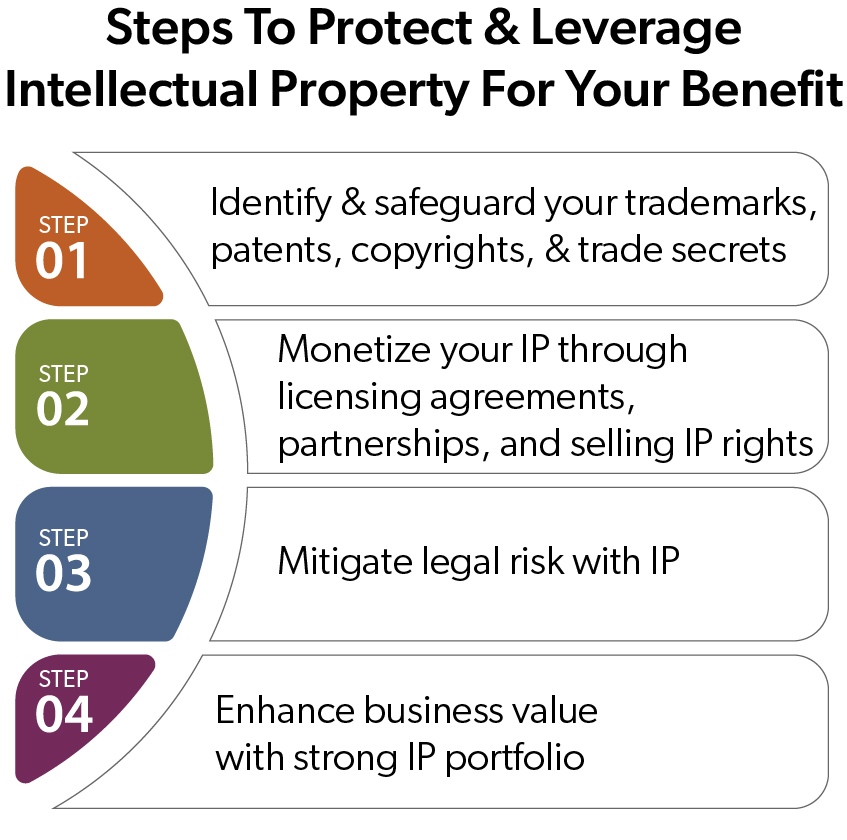

In today’s business landscape, intellectual property (IP) is a valuable currency that can significantly enhance the long-term value of your business. Whether you’re launching a startup or scaling an existing business, it’s crucial to recognize the strategic importance of IP and take proactive steps to protect and leverage it for your benefit through a few steps, including:

In today’s business landscape, intellectual property (IP) is a valuable currency that can significantly enhance the long-term value of your business. Whether you’re launching a startup or scaling an existing business, it’s crucial to recognize the strategic importance of IP and take proactive steps to protect and leverage it for your benefit through a few steps, including:

- Identifying and protecting your IP. Identify and safeguard your intellectual property assets, including trademarks, patents, copyrights, and trade secrets. Registering these assets can provide legal protection and establish your ownership rights.

- Monetizing your company’s IP. Beyond protection, explore opportunities to monetize your IP. Licensing agreements, partnerships, and even selling IP rights can generate additional revenue streams for your business.

- Mitigating legal risk with IP. Intellectual property can act as a shield against legal challenges. A strong IP position also can deter potential litigants and provide a basis for defending your business against infringement claims.

- Enhancing business value. Investors and potential buyers often view strong IP portfolios as a competitive advantage, which can drive up your company’s valuation during a sale or investment negotiation. Robust IP also presents a barrier to entry for competitors, deterring competitors from copying your products or services and preserving your market share and profitability.

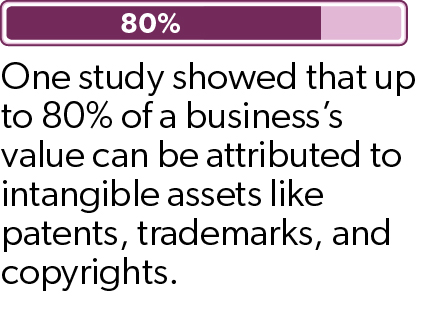

“Protecting your IP is a basis of forward-thinking entrepreneurship,” Howe says. “One study showed that up to 80% of a business’s value can be attributed to intangible assets like patents, trademarks, and copyrights. Starting your business with the end in mind means safeguarding these assets, fortifying your legacy, and maximizing your long-term worth.”

“Protecting your IP is a basis of forward-thinking entrepreneurship,” Howe says. “One study showed that up to 80% of a business’s value can be attributed to intangible assets like patents, trademarks, and copyrights. Starting your business with the end in mind means safeguarding these assets, fortifying your legacy, and maximizing your long-term worth.”

Work With Experienced Professional Advisors

Navigating IP, taxes, and estate planning is not typically within the expertise of an entrepreneur, so it’s important to find people you trust to have your business’s best interests in mind. Attorneys who can navigate the legal intricacies, accountants who ensure financial compliance, bankers who provide vital financial support, and Private Wealth experts who help you safeguard your wealth and secure your future – these professionals are your compass and your shield.

“When you look for professionals to help your business, prioritize those who don’t just offer services but also value lasting partnerships,” Howe says. “Look for proactive experts who focus on your long-term success — they understand that it’s the true measure of their expertise and commitment.”

These experts offer insights and strategies gained through years of experience – invaluable assets as you steer your business toward success and plan for the future. A few tips to find relationship-driven experts include:

- Ask for recommendations. Get recommendations from former colleagues, mentors, or other business owners. Word-of-mouth referrals provide valuable insights into the reputation and performance of potential advisors for your business.

- Evaluate their credentials carefully. Look for relevant certifications, years in practice, and a track record of working with businesses like yours.

- Seek specialization. Advisors who specialize in your industry or niche are more likely to understand specific challenges and opportunities your business will face.

- Get client references. Speaking directly with those who work with an advisor provides valuable insight into their approach and their responsiveness.

- Prioritize responsive, clear communication. Choose advisors who can explain complex concepts clearly and concisely, ensuring you fully understand their recommendations and strategies. Timely communication and accessibility are essential for a successful partnership.

- Understand their fee structure. Transparent pricing and a clear outline of their services help you to assess the value you’ll receive.

- Gauge their priorities. Is it difficult to get in touch with your banker or Private Wealth expert? Some banks and firms prioritize clients based on their level of wealth. Others, like First Business Bank, make structural business decisions to support and prioritize your ongoing success and are committed to building lasting partnerships, which is more beneficial in the long run.

“We see too many business owners who prioritize their business and don’t think about their personal wealth,” Howe says. “Then, at the end of the line, they often haven’t taken the right actions to ensure the full value of their business transitions to their heirs. Their business is usually the bulk of their wealth, so they need to approach starting a business by also protecting their personal wealth as it grows.”

Starting your business with the end in mind is a strategic necessity. Succession planning, tax considerations, intellectual property, and the importance of professional advisors each play a crucial role in shaping a business’s trajectory.

By embracing these strategic principles, you’re starting a business and shaping a legacy. It’s a journey worth taking with vision, planning, and a trusted team by your side.